unlevered free cash flow dcf

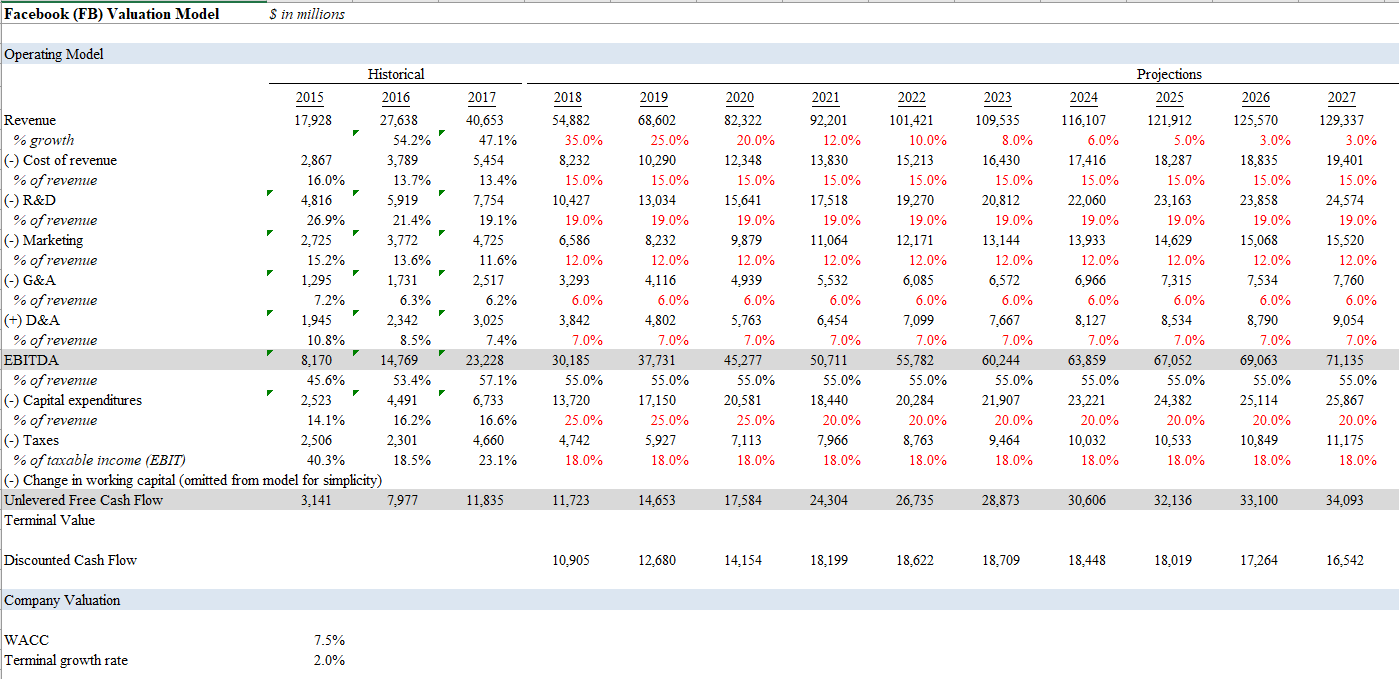

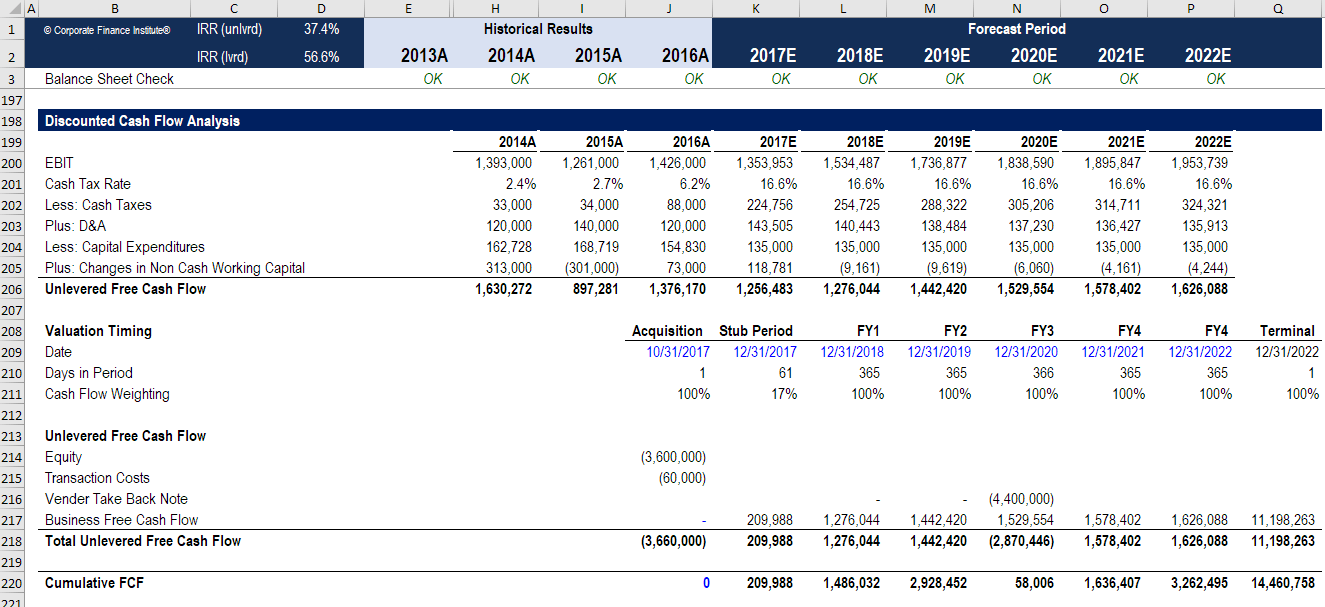

The process of building a levered DCF model can be broken into the following five steps. Putting Together the Full Projections.

Dcf Model The Complete Guide To Building A Discounted Cash Flow Model

G the perpetual growth rate.

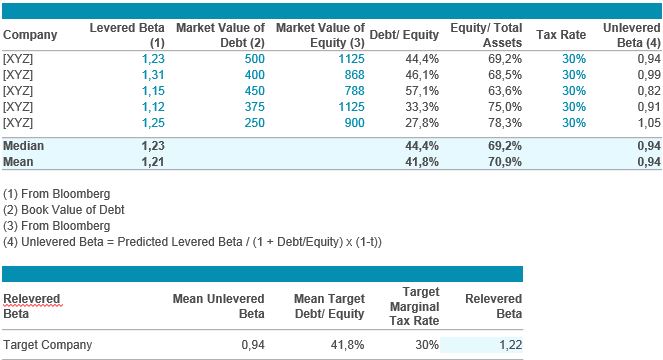

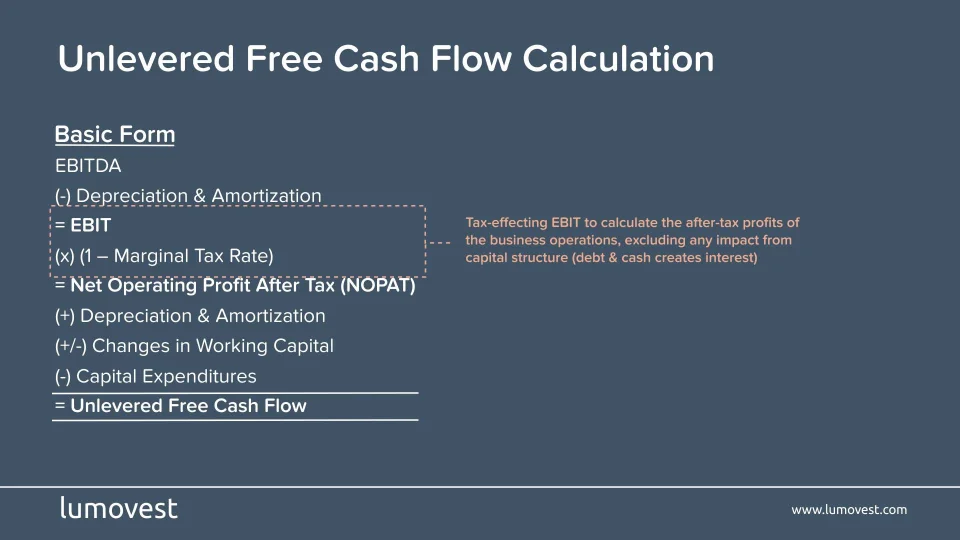

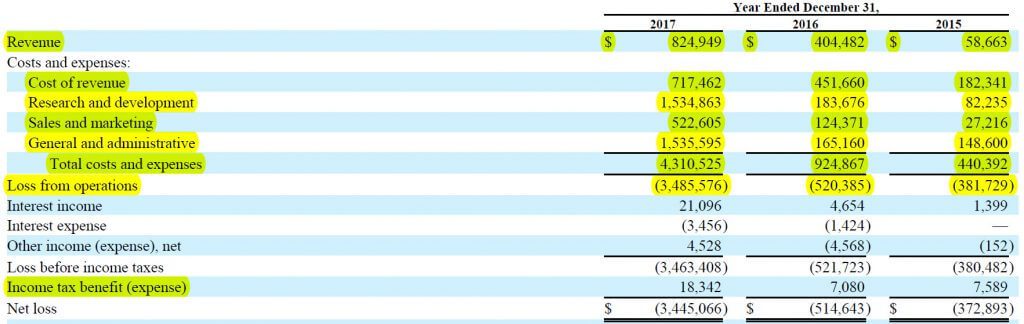

. The first step is to compute the un-levered beta from a sample of companies Earn passive income by directly investing in properties from around the US Jul 4 2018 - This Hotel Valuation. Unlevered Free Cash Flow Formula in a DCF. Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx.

If you use a levered free cash flow value with interest expense subtracted you are effectively calculating. The companys levered free cash flows the remaining cash. The look thru rule.

Well free cash flow should correspond with your discount rate. The Weighted Average Cost of Capital WACC. Unlevered Free Cash Flow Formula.

Unlevered Free Cash Flow - UFCF. Unlevered free cash flow. This metric is most useful when used as part of the discounted cash flow.

Internal Revenue Code that lowered taxes for many US. The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

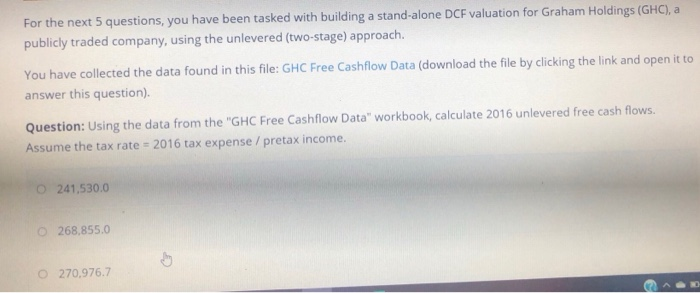

A DCF valuation will not directly apply a levered free cash flow metric into its formula as it uses unlevered free cash flows as the proxy for estimating an assets value. Each company is a bit different but a formula for Unlevered Free Cash Flow would look like this. Most DCF analyses use 5 or 10-year projection periods.

FCF n last projection period Free Cash Flow Terminal Free Cash Flow. Basic Definition of Levered FCF and Excel Demo 510. We begin the DCF analaysis by computing unlevered.

Unlevered Free Cash Flow STEP 33. The present value of the unleveraged cash flow UFCF or enterprise cash flows discounted at. Unlevered Free Cash Flow.

Forecast Free Cash Flow to Equity FCFE. To build this model we will take the data we calculated from Intel in 2020 and project what kind of value the company is worth. A complex provision defined in section 954c6 of the US.

Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs. Changes Required in a Levered DCF Analysis 1044. Unlike levered free cash flow or free cash flow to equity FCFE the UFCF metric is unlevered which means that the companys debt burden is not taken into account.

R the discount rate aka. Projecting cash flows over a longer period is inherently more difficult. Table of Contents for Video.

Unlevered free cash flow is used to remove the impact of capital structure on a firms value and to make companies more comparable. A shorter projection period increases the accuracy of the. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity.

How to Calculate Unlevered Free Cash Flow. Its principal application is in valuation where a discounted. Both approaches can be used to produce a valid DCF valuation.

Start with Operating Income EBIT on the companys.

Discounted Cash Flow Dcf Valuation Investment Guide

Dcf Model Tutorial With Free Excel Business Valuation Net

Unlevered Free Cash Flow Ufcf Lumovest

Understanding The Differences Between Levered And Unlevered Free Cash Flow Article

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Ufcf Fundsnet

Unlevered Free Cash Flow Definition Examples Formula

Dcf Analysis Pros Cons Most Important Tradeoffs In Dcf Models

Financial Modeling Dcf Model Ms Excel Excel In Excel

What Is Free Cash Flow Calculation Formula Example

Free Cash Flow Yield What Is Fcf Yield

Discounted Cash Flow Analysis Street Of Walls

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

How To Value A Company Using Discounted Cash Flow Analysis Dcf Stockbros Research

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

For The Next 5 Questions You Have Been Tasked With Chegg Com

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

Unlevered Free Cash Flow What Goes In It And Why It Matters Youtube